Real Estate Capital Investments: A Path to Passive Revenue

Purchasing property for cash flow is one of one of the most reliable methods to produce passive income and develop lasting riches. Whether you're a seasoned investor or just beginning, understanding the fundamentals of cash flow investments can help you optimize returns and create monetary stability.

What is Property Capital Investing?

Property capital financial investments concentrate on getting properties that generate consistent rental income. The objective is to make sure that rental income exceeds costs, consisting of mortgage repayments, real estate tax, upkeep, and monitoring charges, causing a consistent stream of easy revenue.

Why Purchase Cash Flow Property?

Easy Revenue Generation-- Normal rental revenue gives monetary safety and security.

Wealth Structure Over Time-- Recognition and equity development increase your total assets.

Tax Benefits-- Financiers can take advantage of reductions such as mortgage interest, depreciation, and property costs.

Rising Cost Of Living Protection-- Rental earnings has a tendency to climb with inflation, protecting buying power.

Diverse Investment Opportunities-- Capitalists can choose from domestic, industrial, and multi-family homes.

Ideal Realty Markets for Cash Flow Investments

New York City & Surrounding Locations-- High rental demand and varied building alternatives.

Saratoga Springs, NY-- A expanding market with strong tourism and rental potential.

Midwestern & Southern States-- Affordable homes with eye-catching rent-to-price ratios.

Suburban & College Towns-- Consistent demand from pupils and professionals.

Trick Factors to Consider When Spending

1. Favorable Cash Flow Estimation

Make certain rental revenue goes beyond expenditures.

Utilize the 1% Policy: Regular monthly lease ought to be at least 1% of the residential or commercial property's purchase price.

Compute Internet Operating Earnings (NOI) and Cash-on-Cash Go back to assess https://greenspringscapitalgroup.com/available-properties/ earnings.

2. Residential Property Kind Choice

Single-Family Homes-- Easier to handle, steady admiration.

Multi-Family Features-- Greater cash flow potential, multiple revenue streams.

Short-Term Rentals-- High-income prospective however subject to market changes.

Commercial Property-- Long-lasting leases with company lessees.

3. Funding & Leverage

Discover home loan options and low-interest funding.

Use utilize sensibly to enhance acquiring power.

Think about creative funding techniques like vendor financing or partnerships.

4. Residential Property Administration Technique

Hire a professional residential or https://greenspringscapitalgroup.com/available-properties/ commercial property supervisor for problem-free investing.

Apply renter testing processes to lessen risks.

Preserve residential or commercial properties to improve tenant fulfillment and retention.

Challenges & Dangers of Capital Investing

Job Fees-- Empty systems lower income capacity.

Market Variations-- Economic slumps can influence rental demand.

Unforeseen Expenditures-- Maintenance, repair work, and real estate tax can influence cash flow.

Renter Concerns-- Late settlements or residential or commercial property damages can bring about financial losses.

Techniques for Making Best Use Of Real Estate Cash Flow

Purchase High-Demand Locations-- Pick areas with solid rental demand and job growth.

Discuss Positive Lending Terms-- Lower rate of interest enhance capital.

Lower Running Prices-- Implement energy-efficient solutions and affordable maintenance.

Boost Rental Income-- Upgrade properties, supply provided rentals, and give features.

Utilize Tax Obligation Benefits-- Make use of deductions and tax techniques Real estate cash flow investments to optimize returns.

Property capital investments provide an outstanding opportunity to generate easy revenue and construct long-lasting riches. By choosing the right property, handling expenditures successfully, and purchasing high-demand areas, investors can develop a lasting income stream and achieve economic flexibility. Whether you're searching for single-family rentals, multi-unit properties, or business investments, tactical capital investing can establish you on the path to success.

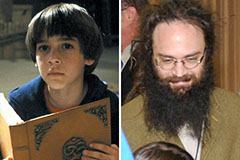

Barret Oliver Then & Now!

Barret Oliver Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!